The COVID-19 pandemic last year deeply affected the real estate sector in all parts of the country and all its stakeholders. However, the Union Budget 2021-22 has raised a lot of expectations of the industry. Experts believe that the budget will give the industry a major boost to get recovery. Developers and buyers alike hope that changes like tax cuts and price reforms will help stabilize the industry.

Overview of Union Budget 2021 with regard to the Real Estate Sector

The real estate sector has received a boost with the recommendations of the Projects like ‘Housing for All’ and ‘Pradhan Mantri Awas Yojana‘ (‘PMAY’) which have always been in focus under the Modi regime. Through the changes proposed to be implemented, it is clear that measures such as tax holidays for affordable housing and tax exemptions in the interest of migrant workers in respect of rental housing projects point to a priority that the housing and real estate sector enjoys in the present central government policy and execution plan.

Keeping in view the fiscal deficit affecting the economy with the onset of the pandemic in 2020; The finance ministry had to decide judiciously with limited scope for any major announcement. The main approach observed with respect to the real estate sector was the government’s policy of promoting and facilitating ‘Housing for All’, with prioritization and increasing access and affordability of housing.

Here is what the real estate sector gained from Union Budget 2021:

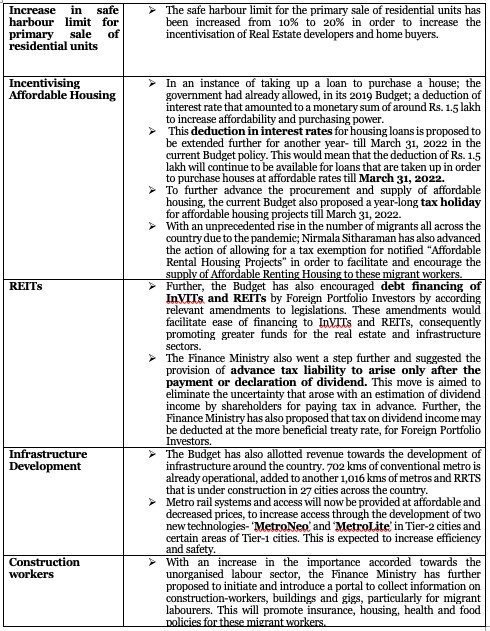

- Increase in secure harbor restriction of residential gadgets for foremost sale:

To incentivize actual property builders and domestic buyers in the real estate sector, it is proposed to extend secure harbor restriction from the present 10% to 20% for the special important sale of residential units.

2.Affordable Housing: To boost increase and consumption in the real estate sector, Sitharaman prolonged the tax exemption for low-cost housing for one year. The central authorities in the finances of July 2019 supplied an extra profits tax deduction of up to Rs 1.5 lakh for domestic loans. The eligibility for this tax deduction used to be prolonged through Sitharaman until March 31, 2022. This will assist convey sparkling provide to the section and preserve the demand for low-priced housing buoyant in 2021.

- REIT : Debt financing of overseas portfolio traders of InvITs and REITs will be made feasible with the aid of making fundamental adjustments in the present rules. It will moreover enhance get entry to InvITS and REITs for funding, consequently developing funding for the infrastructure and authentic property sectors.

In order to ornament investment in the real estate sector, the establishments had eliminated the Dividend Distribution Tax (DDT) in the closing economical. The FM has now encouraged that dividend repayments to REITs/InvITs be eliminated from TDS to supply ease of compliance.

Further, as the quantity of dividend profits can’t be precisely decided with the aid of the shareholders to pay improve tax, the FM recommended that they enhanced tax legal responsibility on dividend earnings must be made solely after dividend declaration/payment. For foreign portfolio investors, the FM also suggested allowing dividend income tax deduction at a lower compounding rate.

- Infrastructure Boost: Two new technologies, i.e., ‘Metrolite’ and ‘Metronio’, will be implemented in the peripheral areas of Tier-II cities and Tier-I cities to provide the Metro Rail System at a much lower cost with equal experience, comfort, and safety.

Infrastructure funding requires a professionally managed development financial institution, to act as a provider, promoter, and catalyst. Hence, the FM will present a consignment to create a DFI. To take profit of this institution, Sitharaman has selected a complete of Rs 20,000 crore.

- Resolution on Stressed Assets: The high level of provisioning of stressed assets by public sector banks calls for steps to be taken to clean the bank accounts. To consolidate and take over the current harassed debt, an Asset Reconstruction Company and Asset Management Company will be fashioned and then the belongings will be managed and disposed of for the closing understanding of the price of choice funding dollars and different practicable investors.

To ensure speedy disposal of cases, the NCLT framework will be reformed, the e-courts system will be introduced and new modes of debt resolution and special MSME framework will be adopted.

- Social Security for Construction Workers: In order to similarly develop the efforts toward the unorganized migrant labor force, the FM proposed to launch a portal that would acquire applicable statistics on gigs, structures, and development workers, amongst others. This will help in formulating schemes for health, housing, skill sets, insurance, loans, and food for migrant workers. These types of steps will ultimately bring more growth in the real estate sector in the near future.

Analysis of the Union Budget 2021:

A close analysis of the aforesaid changes proposed by the impact of Union Budget 2021 on the Real Estate sector brings to the fore the intention of the government to aid, promote and facilitate growth and development in the real estate sector. The government’s focus on affordable housing and its policies will definitely lead to growth in this sector. Additionally, the infrastructure initiatives in the budget are also highly beneficial and will give a huge boost to the sector, allowing its growth and subsequent development.

However, the current budget policies revolving around the real estate sector have failed to align with the additional demand levels anticipated by the industry stakeholders to sustain the growing demand for housing. To facilitate development, efficient execution and timely implementation are critical. Consistent focus and attention will promote ease of doing business in accordance with the policy of ‘Minimum Government, Maximum Governance. The proposed level of infrastructure spending by the government on metro lines, roads, warehouses, ports etc. is a move that is expected to boost the economic GDP and is, therefore, commendable.

Here is what the real estate sector gained from the WB Budget of 2021-22 :

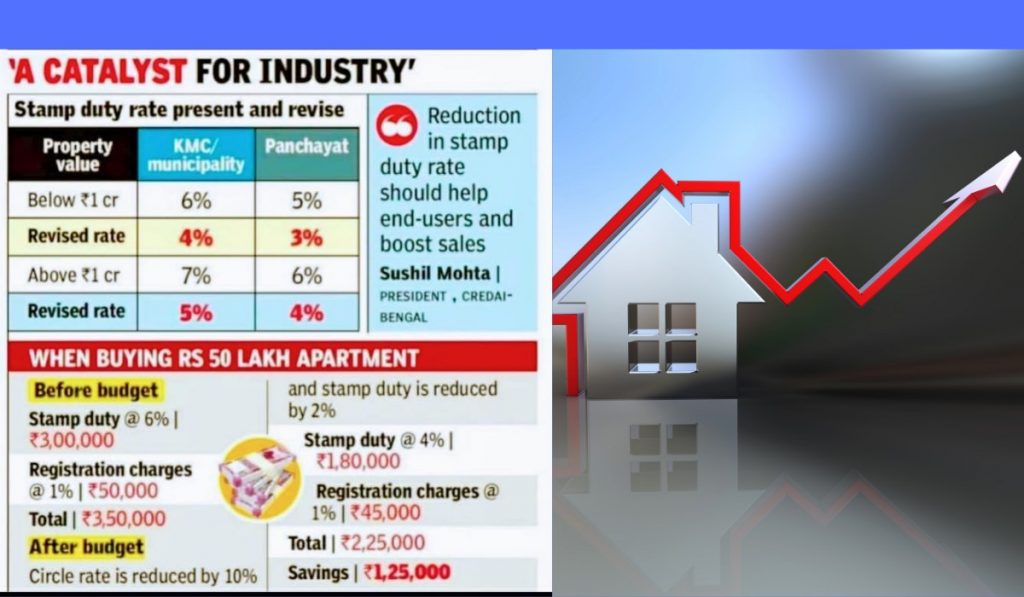

1. The West Bengal government, in its budget for the financial year 2021-22, has announced a 2% reduction in stamp duty rates and a 10 % cut in circle rates. Both these measures are likely to have a multiplier effect on the proceeds and real estate sector of West Bengal.

In a major fulfillment in the real estate industry, West Bengal has proposed a 2% reduction in the stamp rate on property registration in its 2021-2022 budget.

The budget proposes to reduce the stamp duty rate by 2 % from the current average of 6 % in urban areas and 5 % in rural areas (the value of goods in excess of Rs 1 crore attracts another percentage). Exemptions were allowed for the registration of deeds relating to the sale/lease of land/house / flat.

In the third financial statement of the Trinamool Congress government for the third time, it also announced a 10 % reduction in the value of the property, which determines the value in which the property is registered.

Discounts relating to the real estate sector can be obtained if the registration process is completed by October 30, 2021.

The government expects the measures announced for the real estate industry to create more demand in the sector, which will have a significant impact on the economy.

Sushil Mohta, president, Credai, West Bengal, said lowering the stamp rate should help end-users and this should boost sales.

As opined by the experts, the decision will help boost the real estate property demand in the coming months and hence, pave the way for industry revival.

The decision of the government will not only help lower the transaction cost for the buyers but will also facilitate faster clearance of the existing inventory across the State. This will further encourage the developers to launch new projects and infuse fresh investment into the real estate sector.

- In addition to the stamp duty reduction, the government has also announced the construction of 20 lakh houses for people belonging to the SC/ST category.

Together, all these proposals & announcements will help restore West Bengal’s real estate sector on the growth trajectory soon.

Conclusion:

While the various measures proposed to be implemented in the real estate sector through the current budget will positively impact an economy that is still grappling with the hit inflicted by the COVID 19 pandemic, these changes and proposals will be in line with the transition of the industry also, act as marks. Mere existence for real development. For a buyer or an investor to grab all those benefits of budget can think of buying property within 30th Oct 2021 by checking the other steps for safe & secure investment in the real estate sector.

But experts believe the WB budget 2021 together with the union budget will add up more benefits for WB real estate sector to increase sales & help in the quick revival of the market.